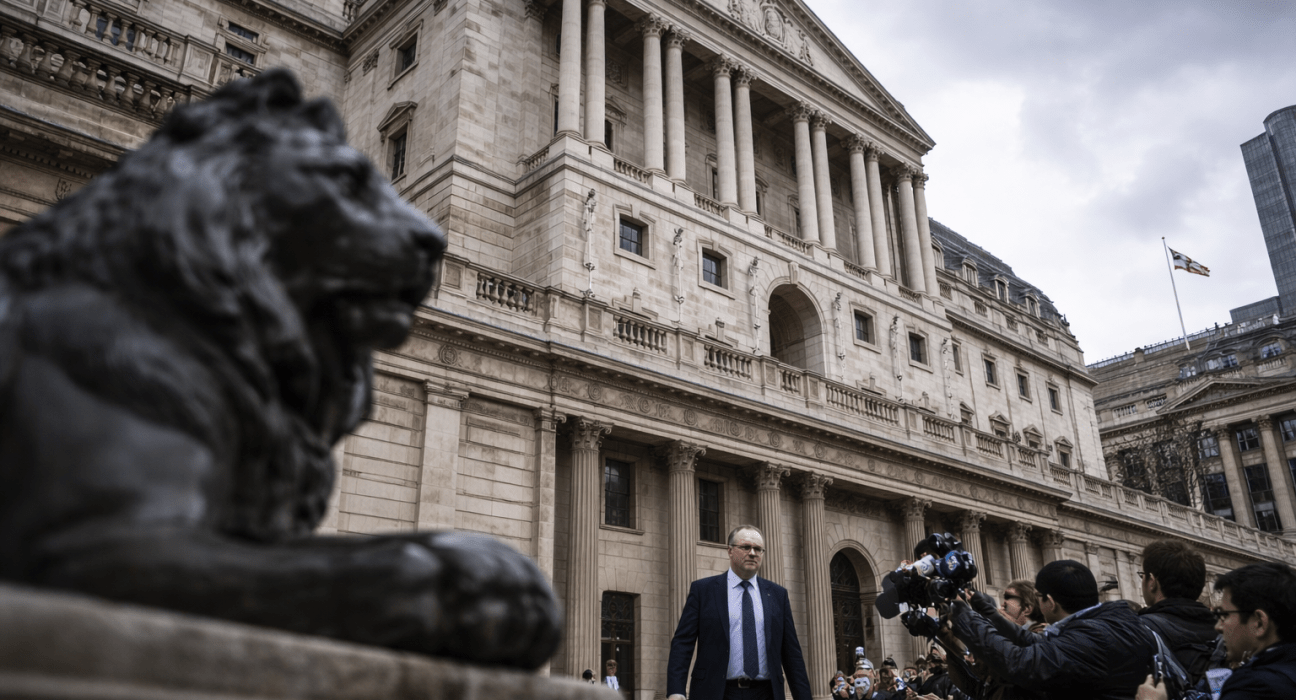

BoE holds rate but narrow vote fuels expectations of spring rate cut

The Bank of England opted to keep its benchmark interest rate at 3.75% on Thursday, meeting market forecasts but revealing a deeply divided Monetary Policy Committee (MPC) as the decision was marked by a narrow 5-4 split. Despite the hold, the central bank signaled that a further reduction is likely in the coming months, provided