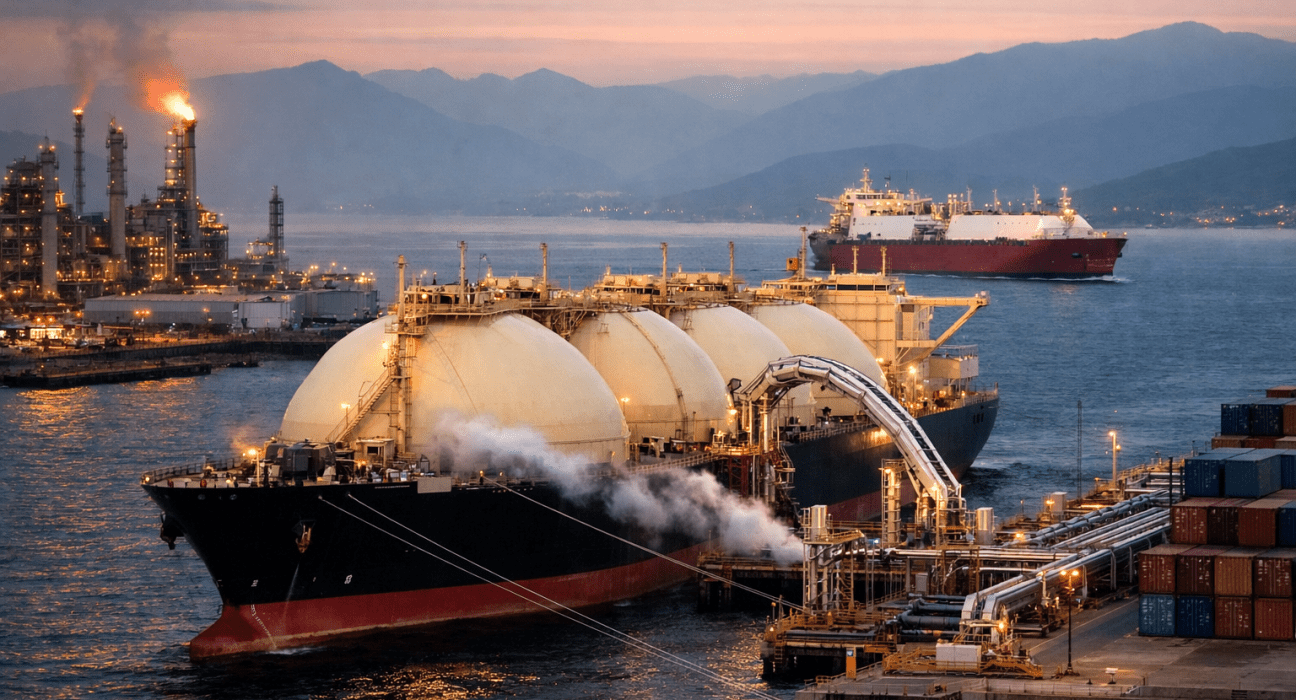

Russia’s pipeline gas exports to Europe hit 50-year low after Ukrainian route closure

Russia’s pipeline gas exports to Europe plummeted by 44% in 2025, reaching their lowest level since the mid-1970s, driven by the closure of the Ukrainian route and the European Union’s ongoing phase-out of Russian fossil fuel imports, Reuters calculations showed on Tuesday. The European Union has made a firm declaration that it intends to completely