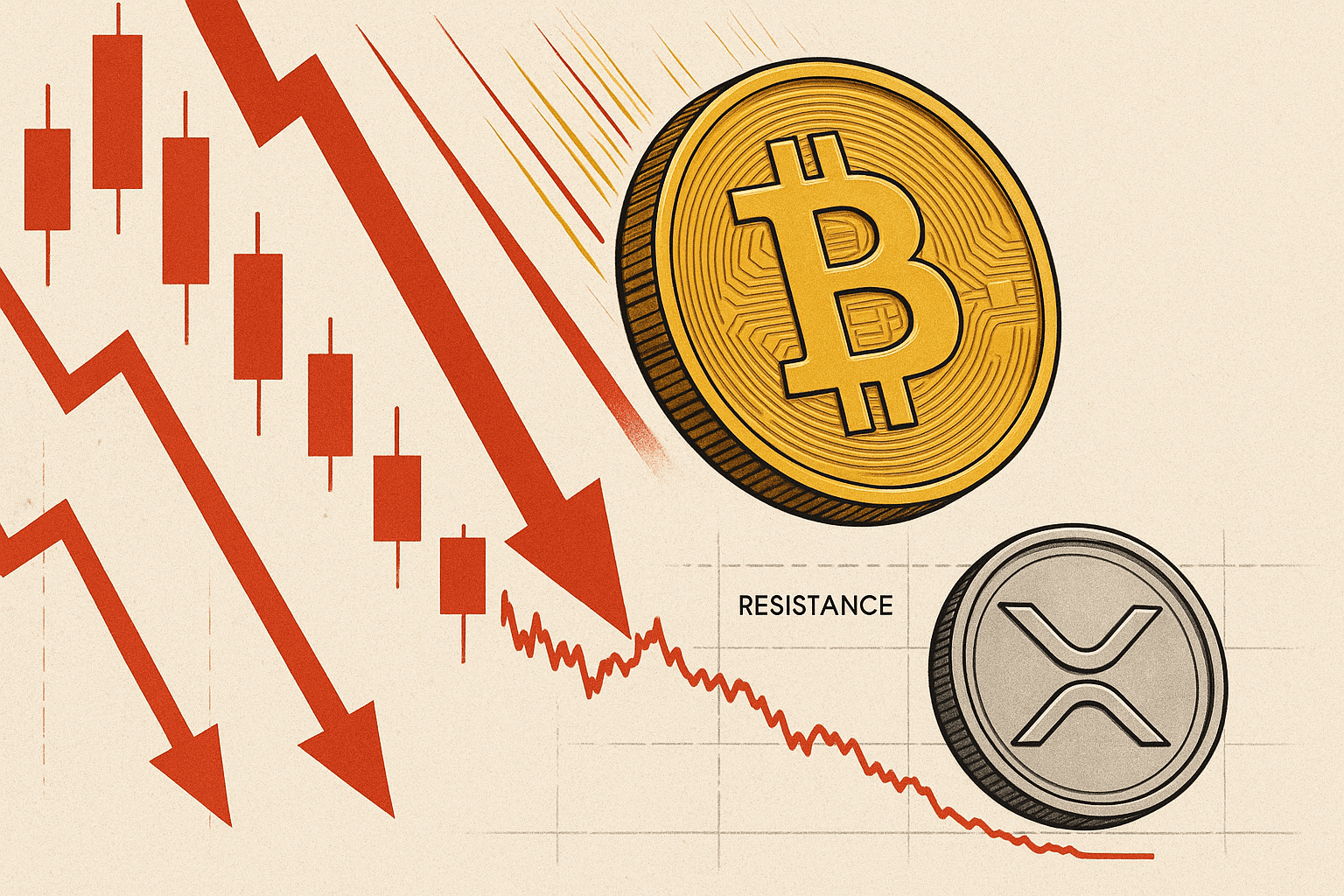

Bitcoin’s slide below the $90,000 threshold has deepened a month-long downturn that has erased the cryptocurrency’s gains for 2025 and unsettled sentiment across the digital-asset landscape.

The world’s largest token fell as much as 2% during Asia trading, and 5% in the last 24 hours, extending a pullback from its early-October record above $126,000 and reviving concerns about the durability of this year’s rally.

At the time of writing, the token was trading at $89,955.27.

The decline marks Bitcoin’s first sustained move under $90,000 since April, when prices tumbled to $74,400 after President Donald Trump’s initial tariff proposals rattled global financial markets.

Now, a different set of pressures which includes shifting expectations for US monetary policy, weakening risk appetite, and stretched speculative positioning, is driving the downturn.

Macroeconomic headwinds reassert themselves

Market participants point to increasing uncertainty over the Federal Reserve’s next steps as a central driver of Bitcoin’s renewed weakness.

Traders have scaled back expectations for a December interest-rate cut, with odds dropping below 50%, reducing demand for speculative assets that had benefited from looser policy bets.

As stock markets slip from recent highs and broader risk sentiment deteriorates, Bitcoin has been left exposed.

Bitcoin’s reversal also follows the early-October selloff that triggered more than $19 billion in liquidations and erased over $1 trillion in token market value.

While institutional investors have largely maintained their positions, retail engagement has thinned markedly.

Dip-buying, once a reliable source of short-term support, has faded, especially across highly speculative altcoins.

Another pressure point comes from public companies with large digital-asset treasuries.

Firms such as Michael Saylor’s Strategy Inc., which accumulated significant crypto holdings earlier in the year, now face mounting strain as prices fall below key acquisition levels.

Some may be forced to reassess or rebalance positions if the downturn continues.

Meanwhile, options markets suggest traders are preparing for additional losses.

Demand for protective puts at the $85,000 and $80,000 strike levels has dominated recent flows, reinforcing the market’s defensive tone.

Market structure under stress

The latest move underscores how Bitcoin, even after maturing into a widely held macro asset, remains sensitive to shifts in liquidity conditions and investor psychology.

Renewed questions around valuations, particularly after the token’s rapid ascent to all-time highs in October, have encouraged profit-taking.

The absence of clear catalysts for renewed upside has further contributed to caution.

With key technical levels giving way, momentum has turned decisively negative, leaving the market searching for stabilizing forces.

Whether long-term holders remain committed or begin trimming positions will likely determine whether the $90,000 level becomes a temporary floor or a staging point for further downside.

XRP declines in tandem as altcoins lose momentum

The broader softness in digital assets has also affected XRP, which has extended its decline after failing to sustain a brief recovery attempt above $2.30.

The token fell below $2.250 and later the $2.20 threshold, slipping to a low of $2.105 before entering a period of consolidation.

XRP is now trading below $2.20 and under its 100-hourly simple moving average, facing resistance around $2.20 and $2.220 — the latter reinforced by a bearish trend line.

A close above that zone could open the way toward $2.28 and $2.32, but the near-term bias remains negative.

If XRP cannot clear $2.220, analysts warn it could resume its decline, with support levels at $2.120, $2.10, and potentially $2.050.

A break below those levels could expose the token to even deeper losses toward $2.020 and $1.880, underscoring how altcoins remain particularly vulnerable in the current risk-off environment.

The post Why Bitcoin slipped to $90,000? appeared first on Invezz